Prevention of Money Laundering Act:

-

The Prevention of Money Laundering Act (PMLA) was enacted by the Indian Parliament in 2002 to prevent money laundering in India.

-

The act was amended in 2019 to further empower the Enforcement Directorate in dealing with money laundering cases.

-

The chief objective of this legislation is to fight money laundering, that is, the process of converting black money into white

-

The Enforcement Directorate (ED) is responsible for investigating offences under the PMLA.

-

Financial Intelligence Unit – India (FIU-IND) is the national agency that receives, processes, analyses and disseminates information related to suspect financial transactions.

-

Section 45 of the PMLA Act makes it difficult for the court to grant bail/anticipatory bail to the accused once the anti-money laundering law was slapped on the person.

-

Section 4 says that the offences under PMLA Act are to be treated as cognizable and non-bailable.

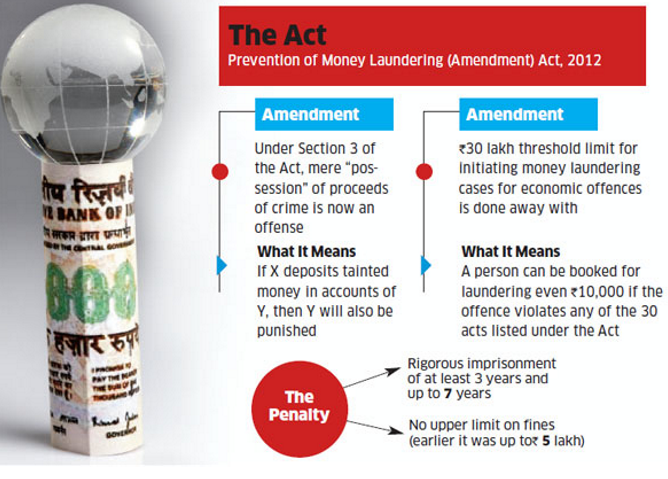

PMLA (Amendment) Act 2012:

-

Amendment added the concept of ‘reporting entity’ which would include a banking company, financial institution, intermediary etc.

-

PMLA 2002 levied a fine up to Rs 5 Lakh but the amendment act has removed this upper limit.

-

It has provided for provisional attachment and confiscation of property of any person involved in such activities.