Utility: Direct Question can be asked on this topic or on failure of present tax regime like BEPS.

Context:

-

The US Treasury Secretary has urged the world’s 20 advanced nations to move in the direction of adopting a global minimum corporate income tax.

-

This will help in ending global race among countries to attract corporations by reducing tax rates.

-

Agreement announced in Paris under the aegis of OECD have endorsed the OECD/G20 Inclusive Framework Tax Deal.

What is the Global Minimum Corporate Tax Rate?

-

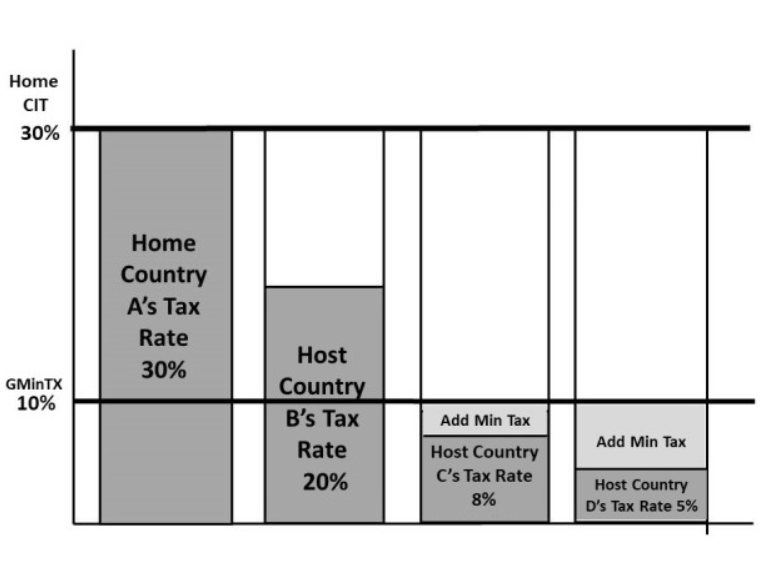

It is a type of corporate tax. Under this, If a company moves some of its operations to another country having low-tax jurisdiction, then the company have to pay the difference between that minimum rate and whatever the firm paid on its overseas earnings.

-

For example, assume Country A has a corporate tax rate of 20 percent and Country B has a corporate tax rate of 12 percent. If the global minimum tax rate is 15 percent. Consider a situation, where Company ABC is headquartered in Country A, but it reports income in Country B. Then Country A will increase the taxes paid by Company ABC. This is equal to the percentage-point difference between Country B’s rate and the global minimum rate(15 percent).In short, Company ABC will have to pay an additional 3 percent of the tax to Country A.

What is Base Erosion and Profit Shifting (BEPS) and why is it failing?

-

The Base Erosion and Profit Shifting (BEPS) programme were initiated in 2013.

-

It aims to curb practices that allowed companies to reduce their tax liabilities by exploiting loopholes in the tax law.

-

Why it failed?

-

To tax Big tech companies the countries have to sign a BEPS agreement among themselves.

-

Over the past decades, there are many countries that enacted tax policies specifically aimed at attracting multinational business. These countries attract investment by lowering corporate tax rates. This, in turn, has pushed other countries to lower their rates as well to remain competitive.

-

Also, there are few Developing countries as well that are not sure if they will receive the right to tax the mobile incomes of Big tech companies

-

Responding to the incentives created by these laws, many multinational corporations have moved their assets to low tax countries. Particularly their ownership of the intellectual property to countries offering them low or even no-tax treatment for the assets they produce.

-

This has impacted countries around the world. As they lose out on an estimated $100 billion per year in tax revenue. India’s annual tax loss due to corporate tax abuse is estimated at over $10 billion.

-

-

So the OECD also asked the countries in the BEPS framework to adopt a consensus-based outcome instead of the country’s individual moves.

What happens if Global Minimum Tax regime is imposed?

-

The US aims to minimize tax incentives and force companies to choose a place in a particular country based on commercial benefits.

-

For example, It is intended to discourage American companies from inverting their structures and operate outside the US, due to the increase in the U.S. corporate tax rate.

-

The proposal, if passed, will give other countries the right to “tax back”. For example, countries can tax,

-

Other jurisdictions have either not exercised their primary taxing right or

-

Have exercised it at low levels of effective taxation.

-

Challenges surrounding the proposal:

-

High Tax rate: OECD was considering a 10-12% Global rate. A high rate of 15% may not be accepted by smaller countries like Ireland. Ireland charges a marginal rate of 12.5 %. They argue that a Global minimum tax would impair fiscal autonomy for smaller jurisdictions to compete with larger economies.

-

Difficult to pass from US itself: US had earlier proposed a rate of 21% that would have generated greater revenues. However, a proposal of a 15% rate may not be passed by the US congress

India’s Stand on Global Minimum Corporate Tax Rate

-

India did not object to the proposal as the same would generate additional revenue for the country.

-

The State of Tax Justice report of 2020 states that India loses over $10 billion in tax revenue due to the use of offshore structures. The popular locations include Mauritius, Singapore, and the Netherlands where there is an almost negligible rate of taxation.

-

If passed, the Indian government can impose a tax on offshore subsidiary units of Indian companies. The taxation can be to such a level that it enables the imposition of an effective Global Minimum Tax on every company.