Bitcoin:

-

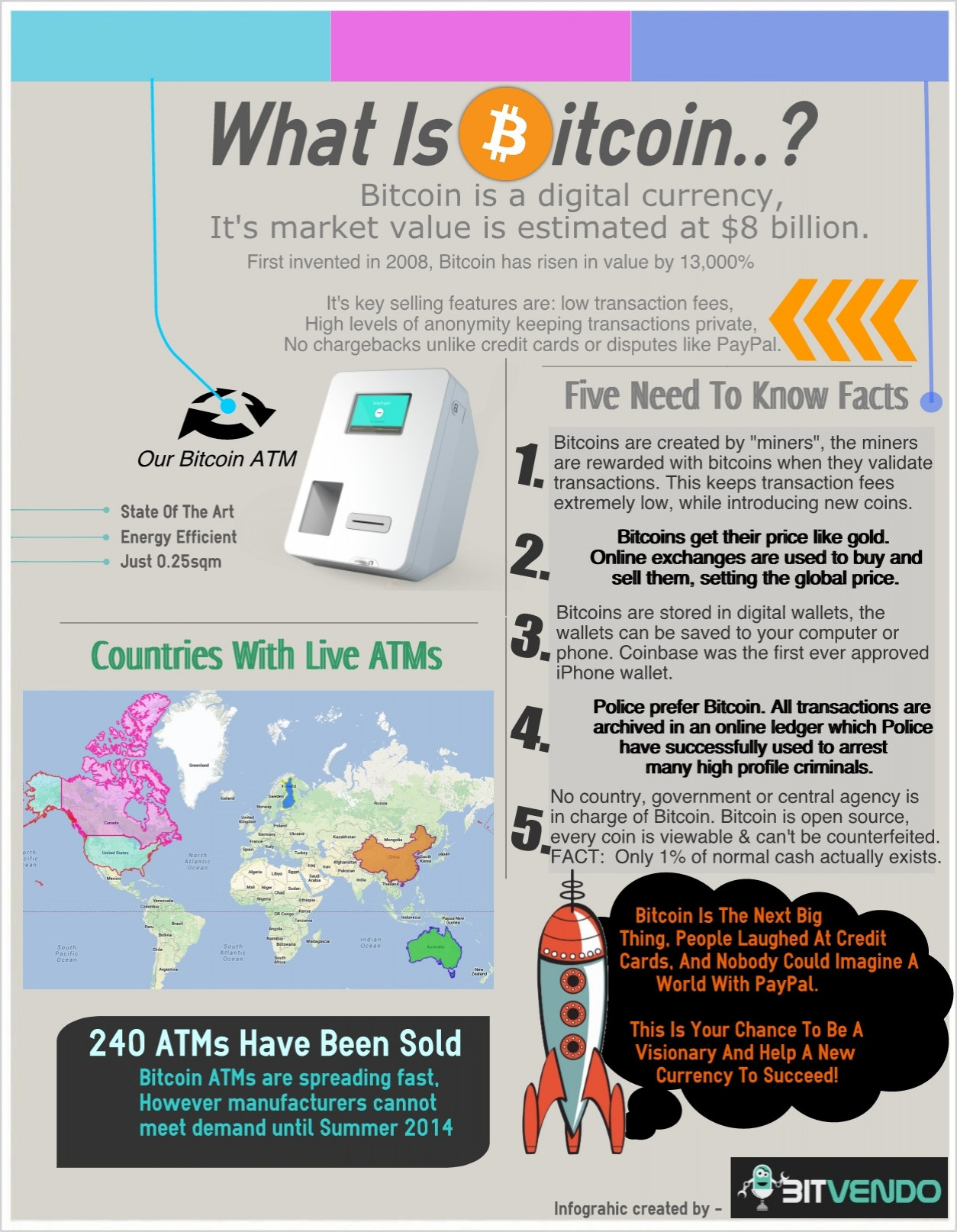

Bitcoin is a type of digital currency that enables instant payments to anyone.

-

Bitcoin was introduced in 2009.

-

Bitcoin is based on an open-source protocol and is not issued by any central authority.

-

It is not regulated by any central bank or government.

-

They aren’t printed, like dollars or euros – they’re produced by people, and increasingly businesses, running computers all around the world, using software that solves mathematical problems.

-

It is also called a “cryptocurrency” since it is decentralized and uses cryptography to prevent double-spending, a significant challenge inherent to digital currencies.

-

Bitcoin is a distributed peer-to-peer digital currency that functions without the inter-mediation of any central authority.

-

It can also be traded on an open market and its exchange rate fluctuates much like a stock market i.e. based on the demand.

-

El-Salvador is the first country to make Bitcoin a legal currency.

Why are Bitcoins popular?

-

Bitcoins continue to remain attractive as a store of value.

-

A major reason seasoned speculators find bitcoins irresistible is its deflationary nature, which makes it inflation-proof. Since there can only ever be 21 million bitcoins, unlike a fiat currency, it cannot suffer a loss in value due to inflation.

History:

The origin of Bitcoin is unclear, as is who founded it. A person, or a group of people, who went by the identity of Satoshi Nakamoto are said to have conceptualised an accounting system in the aftermath of the 2008 financial crisis.

Use:

Originally, Bitcoin was intended to provide an alternative to fiat money and become a universally accepted medium of exchange directly between two involved parties.

-

Fiat money is a government-issued currency that is not backed by a commodity such as gold.

-

It gives central banks greater control over the economy because they can control how much money is printed.

-

Most modern paper currencies, such as the US dollar and Indian Rupee are fiat currencies.

Acquiring Bitcoins:

-

One can either mine a new Bitcoin if they have the computing capacity, purchase them via exchanges, or acquire them in over-the-counter, person-to-person transactions.

-

Miners are the people who validate a Bitcoin transaction and secure the network with their hardware.

-

The Bitcoin protocol is designed in such a way that new Bitcoins are created at a fixed rate.

-

No developer has the power to manipulate the system to increase their profits.

-

One unique aspect of Bitcoin is that only 21 million units will ever be created.

-

A Bitcoin exchange functions like a bank where a person buys and sells Bitcoins with traditional currency. Depending on the demand and supply, the price of a Bitcoin keeps fluctuating.

Legitimacy of Bitcoins (or cryptocurrencies) in India:

-

Government push back: In the 2018-19 budget speech, the Finance Minister announced that the government does not consider cryptocurrencies as legal tender and will take all measures to eliminate their use in financing illegitimate activities or as a part of the payment system.

-

RBI Ban: In April 2018, Reserve Bank of India (RBI) notified that entities regulated by it should not deal in virtual currencies or provide services for facilitating any person or entity in dealing with or settling virtual currencies.

-

SC struck down ban: However, the Supreme Court struck down the ban on trading of virtual currencies (VC) in India, which was imposed by the RBI.

-

The Supreme Court has held that cryptocurrencies are in the nature of commodities and hence they can not be banned.