Fiscal Developments:

-

Sustained revenue collection and a targeted expenditure policy has contained the Fiscal Deficit for April to November, 2021 at 46.2% of Budget Estimates.

-

The revenue receipts from the Central Government (April to November, 2021) have gone up by 67.2% YoY(Year on Year) as against an expected growth of 9.6% in the 2021-22 Budget Estimates.

-

Gross Tax Revenue registers a growth of over 50% during April to November, 2021 in YoY terms.

-

This performance is strong compared to pre-pandemic levels of 2019-2020 also.

-

Tax Revenue forms part of the Receipt Budget, which in turn is a part of the Annual Financial Statement of the Union Budget.

-

During April-November 2021, Capex (Capital Expenditure) has grown by 13.5% (YoY) with focus on infrastructure-intensive sectors.

-

With the enhanced borrowings on account of Covid-19, the Central Government debt has gone up from 49.1% of GDP in 2019-20 to 59.3% of GDP in 2020-21, but is expected to follow a declining trajectory with the recovery of the economy.

-

Buoyant tax revenues and government policies have created “headroom for taking up additional fiscal policy interventions”.

-

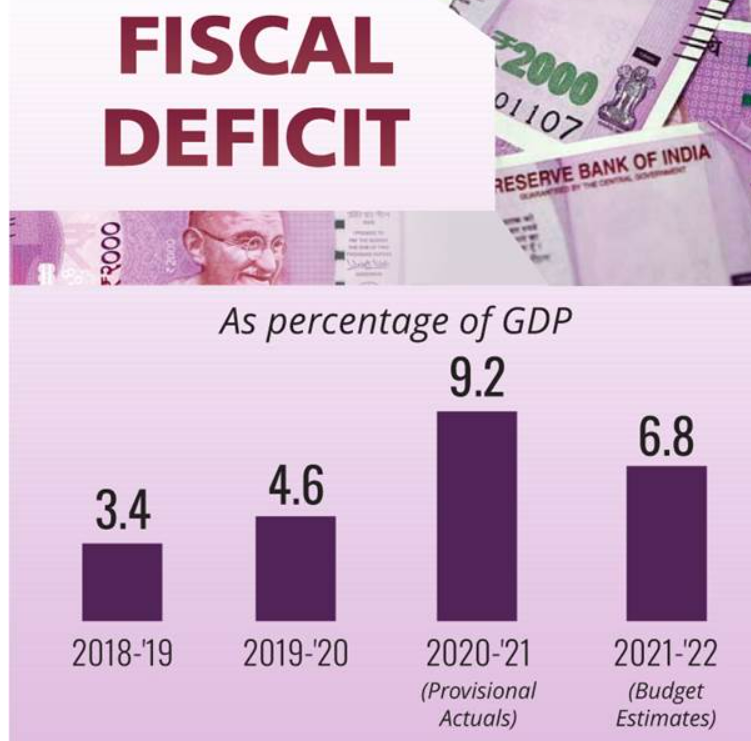

Stressing the need to continue the focus on capital expenditure, it has indicated that the government is on course to achieve the fiscal deficit target of 6.8% of GDP for the current year (2021-22).