Context

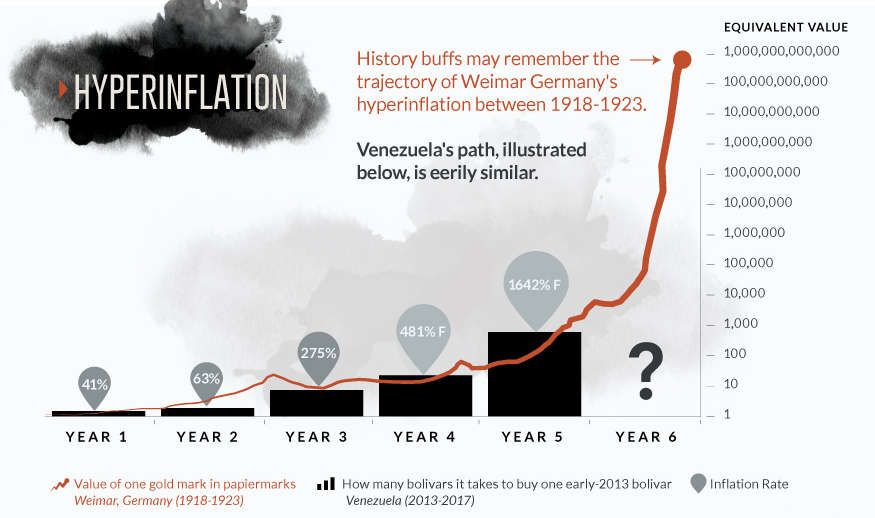

- Hyperinflation, power cuts, and food and medicine shortages are driving millions of Venezuelans out of the country. The country is facing the worst inflations.

Concerns

- The biggest problem facing Venezuelans in their day-to-day lives is hyperinflation.

- $1 US = 248,000 Venezuelan Bolivars, at the official exchange rate

- Prices have been doubling every 26 days on average. This has resulted in many Venezuelans struggling to afford basic items such as food and toiletries.

- With small items like a cup of coffee costing a whopping 2.5m bolivars

Major Cause

- Venezuela is rich in oil, and has the largest proven reserves in the world. But it’s this exact wealth that underpins many of its economic problems.

- Its oil revenues account for about 95% of its export earnings.

- Venezuela’s economy depends mostly on oil. That was great when a barrel of oil was worth $100 a barrel in 2013 and 2014. Now oil prices have fallen to as low as $28.36 — the lowest point in 12 years. As long as oil prices stay historically low, Venezuela will struggle to grow.

- Because it has so much oil, Venezuela has never bothered to produce much else. It sells oil to other countries, and with the dollars it earns, imports the goods Venezuelans want and need from abroad.

- But when the oil price plummeted in 2014, Venezuela was faced with a shortfall of foreign currency.

- This in turn made it difficult to import goods at the same level as before, and imported items became scarcer.

- The result: businesses increased prices and inflation rose.

Other Causes for Inflation

- According to Transparency International, Venezuela is the ninth most corrupt country in the world.

- Members of Maduro’s family and immediate support have been implicated in drug smuggling and hundreds of billions of dollars are believed to have been syphoned out of the economy.

- It is the government’s willingness to print extra money and regularly hike the minimum wage in an effort to regain popularity with Venezuela’s poor,

- Years of excessive government spending on welfare programs, poorly managed facilities and dilapidated farms set the stage for the crisis.

- The government is also increasingly struggling to get credit after it defaulted on some of its government bonds.

- With creditors less likely to take the risk of investing in Venezuela, the government has again taken to printing more money, further undermining its value and stoking inflation.