To suggest steps to promote card payments with an aim to discourage cash transactions.

Terms of reference:

- Recommend various measures to incentivise transactions through cards and digital means, e.g., through tax incentives/rebates, introduction of cash back/lottery.

- Review the payments system in the country and recommend measures for encouraging digital payments.

- Study and recommend need for changes, if any, in the regulatory mechanism under various laws, relevant for the purpose of promotion of payments by digital modes.

- Study feasibility of creating a payments history of all card and digital payments and ensure that merchants and consumers can leverage the data to access.

- Study and recommend ways for leveraging Unique Identification Number (UID) or any other proof of identity for authentication of card and digital transactions.

- Study introduction of single window system of payment gateway to accept all types of cards and digital payments of government receipts.

- Look into the scope of integration of all government systems like Public Finance Management System, Bharatkosh, PayGov and eKuber.

- Identify regulatory bottlenecks and suggest changes. Study global best practices in payments and identify possible market failures along with suitable interventions

Steps taken by government to promote cards:

- The Cabinet had approved withdrawal of surcharge, service charge and convenience fee on card and digital payments.

- It also approved mandating payments beyond a prescribed threshold only through a card or digital mode.

Recommendations:

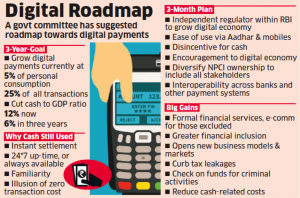

- The Committee has recommended medium term strategy for accelerating growth of Digital Payments in India.

- The strategy must be backed with regulatory regime which is conducive to bridging the Digital divide by promoting competition, interoperability and open access in payments.

- It also recommends inclusion of financially and socially excluded groups and assimilation of emerging technologies in the market.

- It calls for need of safeguarding security of Digital Transactions and providing level playing to all stakeholders and new players who will enter this new transaction space.

- It has suggested inter-operability of payments system between banks and non-banks, up-gradation of digital payment infrastructure and institutions.

- It also recommends a framework to reward innovations for leading efforts in enabling digital payments.

- Greater use of Aadhaar and mobile numbers for making digital payments as easy as cash.

- Proposed to make regulation of payments independent from the function of central banking to give the entire digital payments boost.

- Give Board for Regulation and Supervision of Payment and Settlement Systems (BPSS) independent statutory status within overall structure of RBI.

- Called for amendments to the Payments and Settlement Systems Act, 2007 to provide BPSS explicit mandate for competition and innovation, consumer protection, open access and interoperability, regulations on systemic risks and data protection.

- Operations of payment systems like National Electronic Fund Transafer (NEFT) and Real Time Gross Settlement (RTGS) can be outsourced after a cost benefit analysis.