Facts:

-

Iran has always been one of India’s main suppliers of oil, second only to Iraq and Saudi Arabia, with exports that totalled more than 27 million tonnes last year.

Developments:

-

Before P5+1 deal, India has cut its oil imports from Iran by approximately 20% in 2017, though its global imports have risen by 5.4%

-

Three months later, the then Prime Minister, Manmohan Singh, even visited Tehran to attend the Non-Alignment Summit, despite U.S. objections.

-

Eventually, New Delhi operationalised a ‘rupee-rial’ mechanism, under which half of what it owed Tehran for oil imports would be held in a UCO Bank account and made available to Iranian companies to use for any imports from India.

-

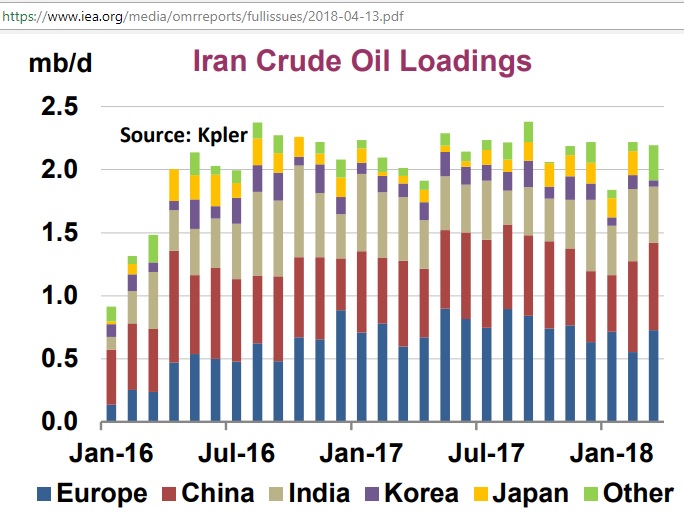

After P5+1 deal, US sanctions were removed and thus import from Iran were increasing.

-

Now after US withdrawal from P5+1 deal, US is again pressurizing major importers from Iran.

Challenges for India:

-

If it rejects U.S. pressure, it risks sanctions as well as incurring the displeasure of its all-powerful friend and defence partner.

-

If it yields, it risks its relationship with traditional partner Iran, access to important trade routes through Chabahar and the International North South Transport Corridor (INSTC), as well as its international reputation.

-

Ties with the U.S. are under strain over several issues, including U.S. trade tariffs and India’s defence procurement from Russia, and a major divergence on Iran will exacerbate the problem with India’s biggest trading partner and fastest growing defence partnership.

-

Moreover, in an increasingly globalised world, where Indian companies compete, any U.S. sanctions will make it hard for refiners, insurers and transport companies to facilitate oil trade, even if India wishes to continue it.

-

On the other hand, India’s investment in the Iranian relationship has increased, making a turnaround much more difficult.

-

Just five months ago, New Delhi rolled out the red carpet for Iran’s President Hassan Rouhani and committed itself to increasing its oil off-take by 25% this year, as part of easing negotiations for the Farzad-B gas fields India is keen to buy a stake in.

-

India has also committed itself to investing $500 million to build berths at Chabahar’s Shahid Beheshti Port, and $2 billion to build a rail line through the Zahedan province to Afghanistan, in an effort to circumvent trade restrictions by Pakistan.

-

Iran’s other oil importers, China and Turkey, have said they will not accept the U.S.’s diktat.

-

While India’s oil supplies are diversified, its options in this game of diplomatic brinkmanship are narrowing.

Iran Vs Other Gulf Countries:

-

India now has to carefully balance its interests in Shia-dominant Iran with its interests in Sunni-dominant Gulf countries such as Saudi Arabia and the UAE.

-

Saudi Arabia and the UAE host about six million overseas Indians and account for an estimated 36% of total remittances to India. Remittances from Iran to India are negligible.

-

Saudi Arabia and the UAE, are enticing India with the promise of greater investments.

-

Abu Dhabi National Oil Company (Adnoc) and Saudi Arabian Oil Company (Saudi Aramco) have promised to invest $44 billion, amounting to a 50% stake, in Ratnagiri Refinery and Petrochemicals Ltd (RRPCL).

-

Representatives of Adnoc and Saudi Aramco have hinted at the possibility of greater investments in India.